Standard & Poor’s affirms Georgia at ‘BB’ with stable outlook

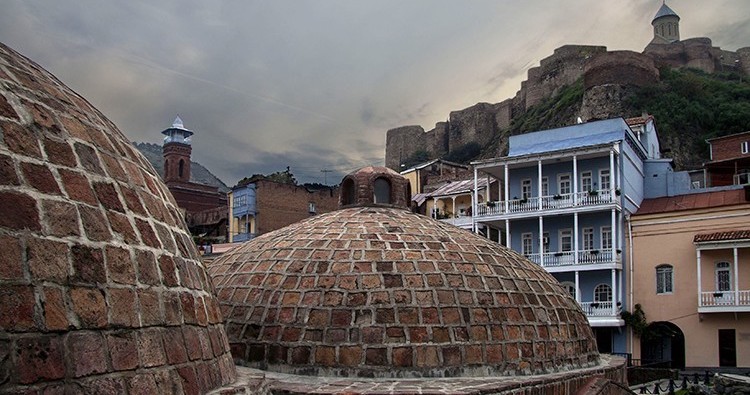

S&P said that Georgia's economy ‘will only recover’ to 2019 levels in 2022. Photo: Nino Alavidze/Agenda.ge

Standard & Poor's (S&P) Global Ratings has affirmed its 'BB/B' long- and short-term foreign and local currency sovereign credit ratings of Georgia with a stable outlook.

S&P reported on August 28 that ‘‘the coronavirus pandemic has pressured Georgia's economic, external, and fiscal metrics by hitting tourism, remittances and foreign direct investment (FDI) inflows.

However, ‘financing secured by the authorities from international financial institutions (IFIs) will mitigate lost foreign exchange (FX) revenues, while covering Georgia's larger twin fiscal and external deficits’.

The ratings on Georgia are constrained by low income levels, as well as by balance-of-payments vulnerabilities, including its import dependence and sizeable external liabilities”, S&P said.

S&P noted in its report that the ratings are supported by Georgia's ‘relatively strong institutional arrangements when compared regionally; its floating exchange rate regime; and the availability of timely, concessional financing from IFIs under extenuating circumstances’.

It also said that Georgia's economy ‘will only recover’ to 2019 levels in 2022:

- The COVID-19 pandemic and associated restrictions on activity will cause Georgia's economy to contract by 6% in 2020.

- Concessional IFI loans will support the policy response and stave off balance-of-payments pressures.

- Changes to the electoral code, enacted in time for the October polls, will allow for more seats to be allocated via proportional votes and a lower threshold to enter parliament.

S&P expects ‘the external environment to remain challenging in the wake of the COVID-19 outbreak’.

Nevertheless, it said, ‘policymakers' efforts to widen Georgia's economic base, diversify its export geography and foreign investment, and develop its infrastructure are likely to maintain strong economic growth while gradually reducing external imbalances in the medium term’.

Tweet

Tweet  Share

Share